Best Online Brokers For Stock Trading & Investing Of 2026

Online brokers for stock trading and investing have become the go-to choice for investors, with studies showing that over 75% of retail users now place trades through online platforms rather than traditional brokerage firms.

While this shift has made investing more accessible, it has also made choosing the right broker more confusing than ever, since many platforms appear similar on the surface.

So, to cut through the noise each broker on our list has been tested and evaluated during real trading and investing scenarios.

From account setup and funding to placing trades, using research tools, and managing portfolios over time.

Our goal is simple: to help you confidently choose from the best online brokers for stock trading based on core functionality, real-world user experience, and the critical balance between advantages and limitations.

Beyond just fees, we consider regulation and capital security to ensure your money is protected, while evaluating the customer support.

Disclaimer: This article contains affiliate links. If you sign up for a stock trading platform through my links, I may receive small affiliate compensation at no cost to you. You can read my affiliate disclosure by going to my privacy policy. The article is for informational and educational purposes only and does not constitute financial, investment, or legal advice.

Best Online Brokers For Stock Trading & Investing

Here are my top picks, based on ease-of-use, customer support and overall reliability in real trading conditions:

1. Webull – Best for commission free trading and advanced tools

2. eToro – Best for beginners who want copy-trading features

3. Robinhood – Best for 24/5 zero-commission stock trading and investing

4. InteractiveBrokers – Best for professional-grade trading tools

5. IG Group – Best for extensive global market access

6. Plus500 – Best for CFD trading across global markets

7. Degiro – Best for European retail investors

8. SpeedTrader – Best for active day traderS

9.Vantage – Best for Forex Trading

10. Hargreaves Lansdown – Best for long-tem UK investors

11. XTB – Best for investing and saving using a single app

12. Interactive Investor – Best for flat-fee investing

13. M1 Finance – Best for automated stock portfolio management

Conclusion

Frequesntly Asked Questions

Recommended Articles

1. Webull

Best For Commission Free Trading & Advanced Tools

Compay Overview

Webull is a technology-driven financial services company and one of the leading online brokers for stock trading and investing.

Founded by Wang Anquan, the company is headquartered in St. Petersburg, Florida.

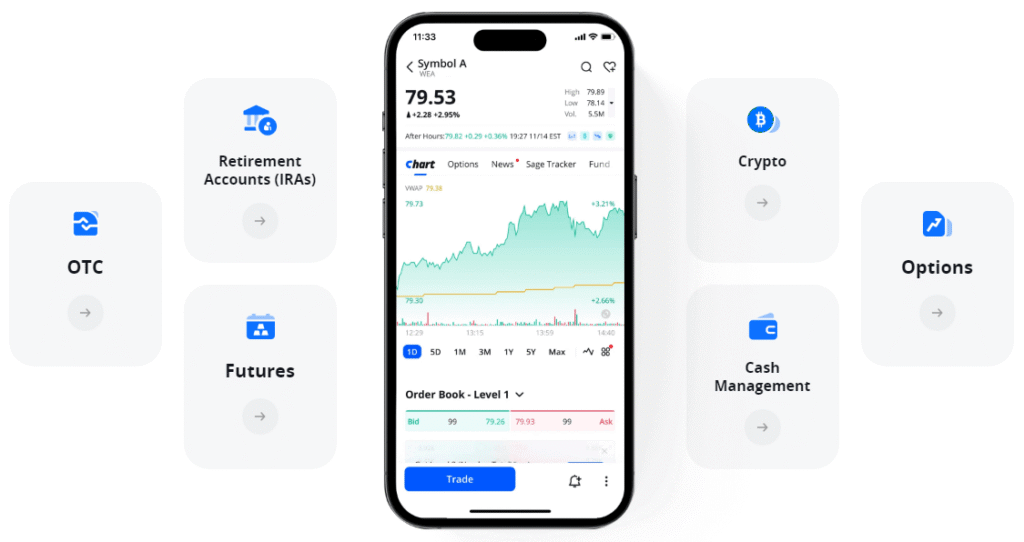

Webull offers a commission-free trading, giving retail investors direct access to global financial markets, including stocks, ETFs, options, futures, and fractional shares, all through mobile, desktop, or web interfaces.

The company’s mission is to democratize investing by combining advanced trading tools, market data, educational resources, and community features in one platform.

Since its U.S. launch in 2018, Webull has experienced rapid growth, expanding into international markets like Europe, Asia Pacific and South America.

According to Webull’s filings, the platform has 24.9 million registered users and 4.7 million funded accounts, indicating that many investors are finding long-term value on the platform.

Key Features

These are the core features that define Webull’s platform and why it stands out among the online brokers for stock trading and investing:

- No minimum balance required to open or maintain a standard brokerage account, making it very accessible for beginners.

- Live quotes and market updates without delays, including pre-market and after-hours trading sessions.

- Extended trading hours: ability to place trades outside regular market hours to capture more opportunities.

- Paper trading, a simulated trading environment that lets users practice strategies with virtual funds.

- Fractional shares: invest in high-priced stocks by buying portions of shares, making diversification more accessible.

- Options trading and analytics: support for multi-leg options strategies with analytical insights and risk metrics.

- Access to margin trading with competitive interest rates for leveraged positions.

- Integrated news, market sentiment, and social features that help users stay informed.

User Experience

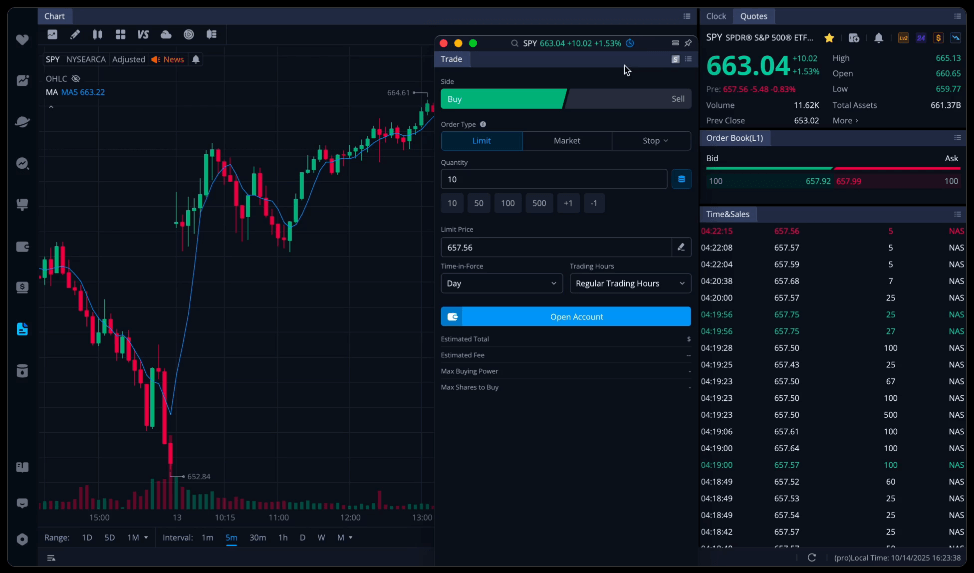

The first thing I noticed when I signed up for Webull was how intuitive the mobile app and desktop felt right out of the gate.

Menus are clean.

Charting tools are highly detailed.

And placing orders is straightforward.

Webull’s commission-free trading for stocks, ETFs, and options keeps costs low while its real-time market data and extended trading hours mean I could react quickly to market moves without feeling constrained by limited access.

In practice, features like paper trading allowed me to test strategies without risk, and advanced charting with technical indicators gave me confidence in making informed decisions.

Advantages

Here are the advantages that make Webull stand out among the online brokers for stock trading and investing:

- Commission-free trading, zero commissions on U.S. stocks, ETFs, and options, helping you keep more of your returns.

- Advanced charting and technical tools: customizable charts, technical indicators, drawing tools, and comparison overlays for in-depth analysis.

Limitations

Webull’s limitations don’t outweigh its strengths, but they’re important to consider.

- Although adequate for getting started, Webull’s educational content is less comprehensive than those brokers focused heavily on beginner education.

- Webull doesn’t offer 24/7 phone support in all regions.

Regulatory Compliance

Webull Financial LLC is a fully regulated broker in the United States.

It’s registered with the Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA), which subjects the platform to strict regulatory standards designed to protect investors and ensure fair market practices.

Webull is also regulated under Commodity Futures Trading Commission (CFTC) and, internationally, holds licenses from regulators including the UK’s Financial Conduct Authority (FCA) and the Monetary Authority of Singapore (MAS) where it operates.

This regulatory framework means Webull must comply with financial reporting, capital adequacy and operational oversight rules that reputable online brokers for stock trading adhere to.

Security Features

Webull incorporates robust security features to protect user accounts and data.

The platform supports two-factor authentication (2FA) to add an extra verification step when logging in, reducing the risk of unauthorized access.

It also uses industry-standard encryption to safeguard data transmission and storage.

In addition, Webull accounts are protected by Securities Investor Protection Corporation (SIPC) insurance, which covers up to $500,000 in securities and cash (including a $250,000 cash limit) if the brokerage fails financially.

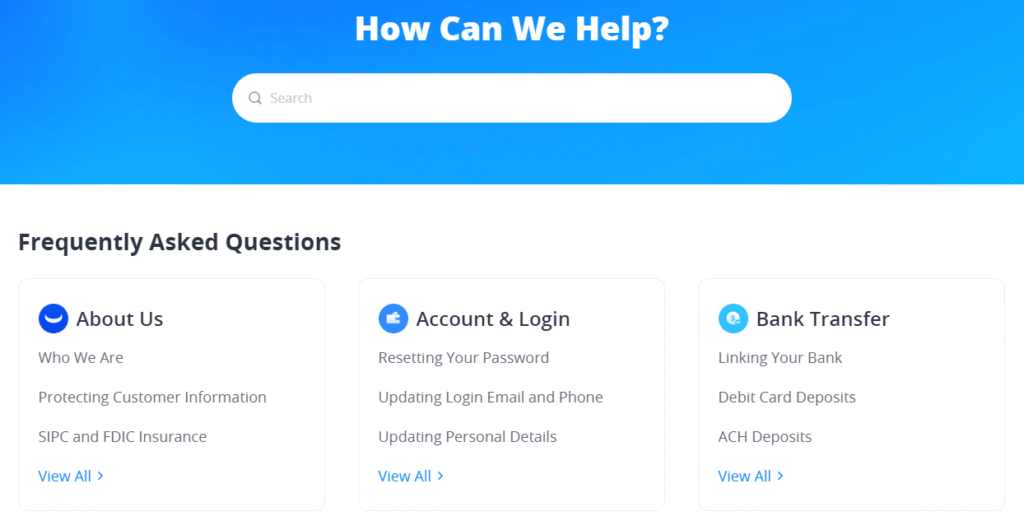

Customer Service

Webull offers multiple customer support channels, including in-app chat, email support, and a help centre with FAQs and guides.

The support team is responsive for routine inquiries, such as help with account setup, basic platform navigation, or troubleshooting login issues.

My inquiries have always been acknowledged promptly, however during peak market hours or high-volume periods, response times can be slower.

2. eToro

Best For Beginners Who Want Copy-Trading Features

Compay Overview

eToro is a global, multi-asset brokerage and social trading platform that has grown into one of the most recognized online brokers for stock trading and investing worldwide.

Registered in 2007 in Tel Aviv by Yoni Assia, Ronen Assia, and David Ring, it set out with a mission to make financial markets accessible for everyday investors.

The platform blends traditional brokerage services with social and copy-trading features.

Today, it boasts 40 million registered users across 75 countries, with more than $17.5 billion in assets under administration.

eToro stands apart from many competitors by combining commission-free trading on U.S. stocks and ETFs with a broad selection of assets, including cryptocurrencies, and commodities within a unified app.

In 2025, eToro completed its initial public offering on the Nasdaq (ticker ETOR), reflecting its substantial growth and credibility in the retail trading space.

Key Features

eToro offers a well-rounded set of tools and services that make it one of best online brokers for stock trading and long-term investing.

- Buy U.S. stocks and ETFs with zero commission, making it cost-effective for long-term investors.

- Social trading feed, an interactive feed where you can follow traders, comment on strategies, and see real portfolios, combining investing with social networking.

- Beginner-friendly interface, a clean, simple design that makes buying, selling, and tracking investments easy for new users.

- Fractional shares, invest in high-priced stocks with small amounts of capital.

- Smart ready-made portfolios based on themes, sectors, or strategies, professionally managed and rebalanced.

User Experience

After using a dozen of online brokers for stock trading and investing, eToro felt suited for newer investors.

The platform is very easy to navigate with a clean interface that makes browsing stocks, placing trades, and tracking performance straightforward even if you have no prior investing experience.

Account setup was smooth, funding was quick, and buying stocks felt like using a modern app instead of a traditional brokerage.

What really stood out in day-to-day use were eToro’s social and copy-trading tools.

Being able to view real portfolios, performance stats, and risk scores helped me build confidence.

While, copying experienced traders made it easier to stay invested without constantly watching the market.

Overall, eToro delivers a beginner-friendly experience that prioritizes simplicity, learning, and long-term investing comfort rather than complex trading tools.

Advantages

eToro’s advantages make it attractive for new investors, social traders, and anyone looking for a simple, all-in-one platform to start trading.

- CopyTrader: automatically replicates the trades of experienced investors, making it ideal for beginners or those who want a hands-off approach.

- Multi-asset access: trade not only stocks and ETFs but also crypto currencies, commodities, forex, and CFDs all from a single account.

Limitations

Here are some eToro limitations compared with other online brokers for stock trading:

- Lacks some of the advanced charting, screening, and analysis tools offered by platforms aimed at active or professional traders.

- Trading non-U.S. stocks, CFDs, or withdrawing funds can incur higher fees compared with some competitors.

Regulatory Compliance

eToro is a fully regulated global brokerage, operating under multiple financial authorities that oversee its activities and protect investors.

In the UK, eToro (UK) Ltd is authorised and regulated by the Financial Conduct Authority (FCA).

eToro (Europe) Ltd is authorised by the Cyprus Securities and Exchange Commission (CySEC), while in Australia the platform is regulated by the Australian Securities and Investments Commission (ASIC).

In the U.S., eToro operates through entities registered with the Securities and Exchange Commission (SEC) and as a member of the Financial Industry Regulatory Authority (FINRA).

With an additional oversight under FinCEN as a money services business.

These multi-jurisdiction licences demonstrate that eToro meets rigorous compliance, reporting, and operational requirements common for established online brokers for stock trading and investing.

Security Features

eToro employs robust security measures to protect users’ accounts and personal information.

All data transmissions on the platform use SSL encryption.

Users are encouraged to enable two-factor authentication (2FA) for an additional layer of login protection.

Client funds are held in segregated accounts at top-tier banks, meaning customer assets are kept separate from the company’s own operational funds.

In the event of insolvency, eligible users may benefit from compensation schemes, such as the UK Financial Services Compensation Scheme or similar protections under CySEC rules.

Customer Service

eToro offers support through multiple channels, including an in-platform help centre with FAQs, a ticket-based email system, and live chat for more immediate assistance.

In some regions, live chat availability is limited to certain hours or to higher-tier account holders, and there is no widely published 24/7 phone support for all users, which means many clients rely primarily on digital correspondence.

In my experience, eToro’s customer service is functional for routine questions and platform navigation.

3. Robinhood

Best For 24/5 Commission-Free Trading & Investing

Compay Overview

Robinhood is a U.S.-based fintech company and one of the most popular online brokers for stock trading and investing, among beginner and mobile-first investors.

Incorporated in 2013 by Vladimir Tenev and Baiju Bhatt with the mission to democratize access to financial markets, Robinhood’s app helped popularize commission-free trading when it launched in 2015.

A move that reshaped the brokerage industry and prompted competitors to eliminate trading fees as well.

Headquartered in Menlo Park, California, Robinhood has grown rapidly; as of 2025 its platform supports over 25 million funded customer accounts and approximately $279 billion in assets under custody, making it one of the largest retail brokerages in the United States.

Beyond stocks and ETFs, Robinhood also facilitates options and crypto currency trading, offers fractional shares, and supports products such as cash management accounts and crypto wallets, all accessible through a single app.

The company has expanded internationally, including to the UK and EU and is publicly traded on the Nasdaq under the ticker HOOD, reflecting its evolution from a start-up into a major fintech player.

Key Features

Robinhood’s core features make the platform one of the most popular choices within the online brokers for stock trading and investing.

- Fractional shares.

- Built-in support for basic options strategies, accessible directly within the trading interface.

- Seamless access to popular digital assets like Bitcoin and Ethereum (availability varies by region).

- A self-custody crypto wallet that allows users to send, receive, and hold supported tokens (availability may vary).

- Schedule automatic purchases of stocks or ETFs on a regular cadence to support long-term investing habits.

- Optional cash management features, including a rewards debit card and competitive interest on uninvested cash.

- Consolidated market news, basic research tools, and customizable watch lists to help users track key trends.

- Eligible users can participate in initial public offerings (IPOs) through Robinhood’s IPO Access program.

User Experience

When I was testing online brokers for stock trading, Robinhood delivered smooth and beginner-friendly experience, with no friction from a usability and accessibility standpoint.

The platform is designed with simplicity in mind.

Account setup was quick, navigation felt intuitive, and placing trades required minimal steps, which removes much of the intimidation new investors often face.

Using the app on a daily basis felt smooth and responsive, with clean visuals that make portfolio performance easy to understand at a glance.

Features like fractional shares and recurring investments worked seamlessly and made it easier to invest consistently without overthinking individual trades.

I also appreciated how market news and price movements are built directly into the interface, keeping everything in one place.

Advantages

Robinhood’s advantages are centred around simplicity, accessibility, and removing barriers that often discourage new investors from getting started.

- True commission-free trading.

- Fast account setup, quick on-boarding and straightforward verification.

- Clean and user-friendly mobile app that makes trading and investing accessible for first-time investors.

Limitations

Even though, Robinhood is one of the top online brokers for stock trading and investing, it has limitations.

- Research capabilities are restricted compared to other platforms that offer more in-depth charting, screeners, and third-party research.

- The simplified interface design can feel too basic for active traders who want customizable trading tools and advanced orders.

Regulatory Compliance

Robinhood Financial LLC and Robinhood Securities LLC are registered broker-dealers with the U.S. Securities and Exchange Commission and are members of the Financial Industry Regulatory Authority.

This framework subjects Robinhood to ongoing oversight, audits, and regulatory standards designed to promote transparency, fairness, and financial stability.

For U.S. brokerage accounts, Robinhood also is a member of the Securities Investor Protection Corporation (SIPC), so client funds are protected up to $500,000 per account (including a $250,000 cash limit) if the broker fails financially.

Robinhood UK is authorised and regulated by the Financial Conduct Authority (FCA), which regulates financial institutions and online brokers for stock trading in the UK.

Security Features

All communications between the Robinhood app/website and servers are secured using Transport Layer Security (TLS) encryption.

The platform supports two-factor authentication (2FA), requiring an additional verification step like SMS or authenticator app when logging in or accessing from a new device.

Customer Service

Robinhood offers customer support through in-app messaging (live chat) and email.

Users can also request a phone call-back from within the app for direct assistance with trading, account, or withdrawal questions.

Support options are accessible 24/7 via chat, and live phone help is typically arranged through a queued call-back rather than direct dialling.

I found the in-app support convenient for routine questions and basic issues, as chat support is available around the clock.

4. InteractiveBrokers

Best For Professional-Grade Trading Tools

Compay Overview

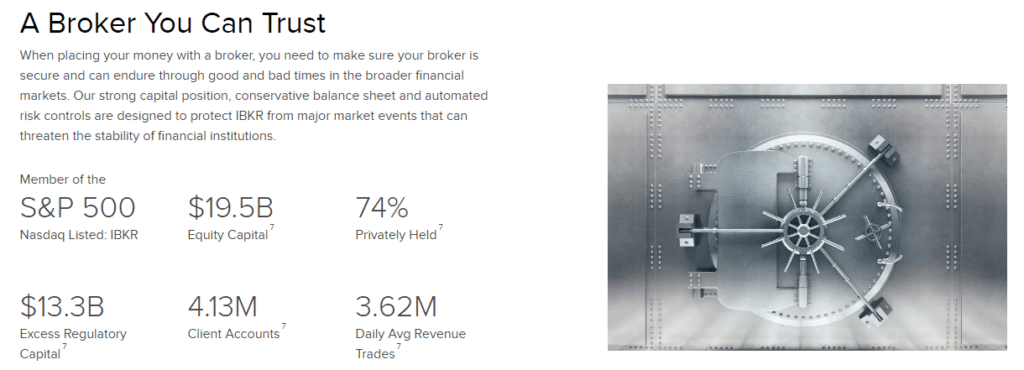

InteractiveBrokers is a well-established and one of the most recognized online brokers for stock trading and investing globally.

Since it was founded in 1978, the company has grown into a major multinational brokerage with operations in over 37 countries and support for dozens of currencies.

InteractiveBrokers operates one of the largest electronic trading platforms in the world, serving more than 3.3 million customers with total client equity exceeding $568 billion.

The online stock broker provides direct market access to a wide range of asset classes including stocks, options, futures, forex, bonds, ETFs and more.

Their platform has been a pioneer in trading technology, introducing early algorithmic trading systems and electronic execution tools.

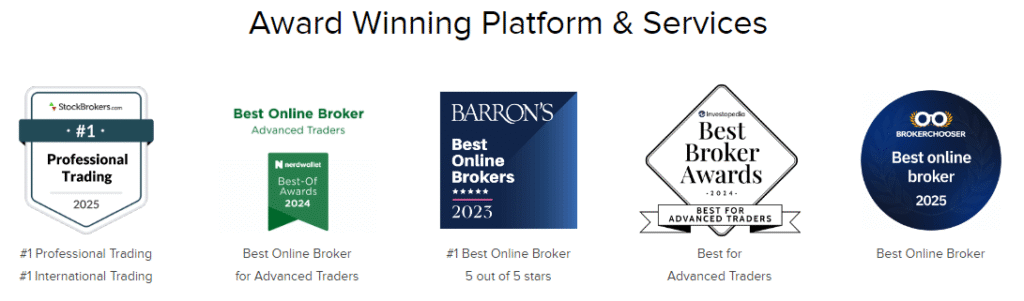

Recognized consistently by industry award programs for its comprehensive trading tools, low-cost structure, and global reach, the company is an excellent choice for professional traders, and high-volume investors.

Key Features

InteractiveBroker’s main features make it widely regarded as one of the most powerful online brokers for stock trading.

- Low-cost trading structure, competitive commission and margin rates.

- Access to institutional-quality research, market scanners, fundamentals, and third-party data subscriptions.

- Sophisticated order routing, conditional orders, and risk-management tools not commonly available on beginner platforms.

- Hold and trade in multiple currencies with automatic forex exxhnage (FX) conversion at institutional rates.

- Robust APIs for developers and quantitative traders to build custom trading systems.

- Real-time margin monitoring, portfolio analytics, and automated risk management tools.

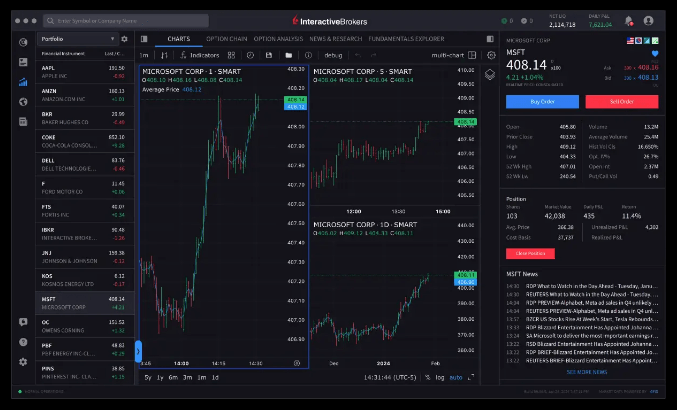

User Experience

InteractiveBrokers stands out for its depth, precision, and professional-grade functionality.

From the first few trades, the platform impressed me with its execution quality and reliability, especially during volatile market conditions.

Once set up, everything from placing complex orders to monitoring margin and portfolio exposure felt deliberate and well engineered.

Trader Workstation provides a level of depth that goes far beyond basic retail platforms, with powerful charting, risk controls, and research tools available in one place.

And while the interface takes time to master, once you do, InteractiveBrokers delivers a professional, no-compromise trading experience.

Advantages

InteractiveBrokers offers flexibility, efficiency, and a sense of institutional-level access that few online brokers for stock trading can match.

- Flagship Trader Workstation (TWS) offers professional-grade charting, analytics, algorithmic trading, and complex order types.

- Trade stocks, options, futures, forex, bonds, ETFs, and funds across more than 160 markets in 37 countries from a single account.

Limitations

InteractiveBrokers drawbacks are especially relevant for new and casual traders and investors.

- While costs are low for high-volume trading, some fees (such as market data subscriptions) may be less advantageous for infrequent or casual traders.

- The platform’s advanced tools and professional interface can feel complex for beginners compared with simpler brokers.

Regulatory Compliance

In the United States, Interactive Brokers LLC is regulated by the Securities and Exchange Commission (SEC) and operates under oversight from the Commodity Futures Trading Commission (CFTC) and the Financial Industry Regulatory Authority (FINRA).

Internationally, InteractiveBrokers is authorised by the UK’s Financial Conduct Authority

(FCA), Australian Securities and Investments Commission (ASIC), Monetary Authority of Singapore (MAS), IIROC (Canada), and other local regulators, ensuring compliance with a wide range of financial laws and standards across jurisdictions.

Security Features

InteractiveBrokers supports two-factor authentication (2FA), including mobile app verification and biometric options, adding an extra layer of login protection and help prevent unauthorized access.

The firm is a member of the Securities Investor Protection Corporation (SIPC), providing up to $500,000 in protection (including up to $250,000 for cash) for U.S. clients in the event of broker insolvency.

In the UK and EU, client assets may maybe covered under the Financial Services Compensation Scheme (FSCS) subject to respective regional limits.

Customer Service

InteractiveBrokers offers multiple support channels, including telephone support, email, and live chat via the Client Portal, covering markets in the U.S., Europe, Asia, and other regions.

Support availability varies by region and language, but the platform provides country-specific phone numbers and extended hours that align with major market sessions.

Unlike many app-only brokers, I found, InteractiveBrokers’ live phone assistance really valuable for complex issues or urgent account needs.

5. IG Group

Best For Extensive Global Market Access

Compay Overview

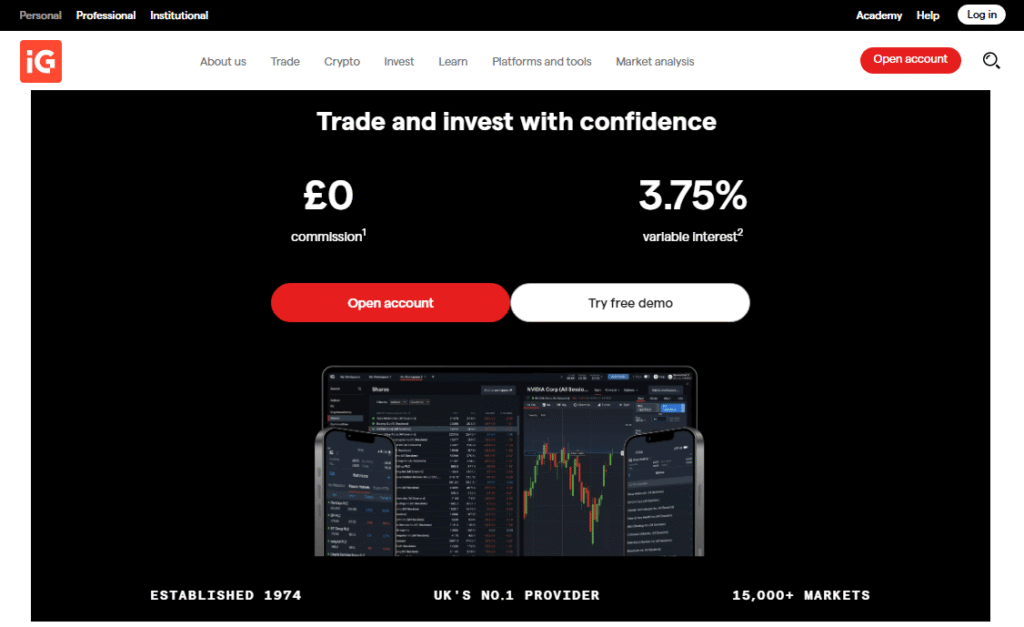

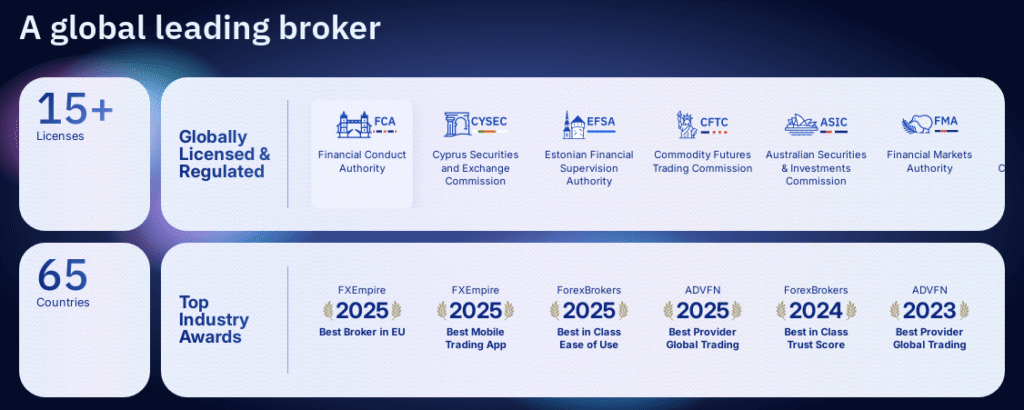

IG Group is a notable online broker for stock trading and financial services company, with roots dating back to 1974 when it was founded in London by Stuart Wheeler.

It began as a pioneer in spread betting and has since evolved into a global trading and investment platform that serves over 400,000 clients worldwide through 16 offices and offers access to 15,000+ financial markets across shares, indices, forex, commodities, options, futures, and so on.

Over its nearly five decades of operation, IG has expanded from its original UK market into Europe, the United States, Asia-Pacific, and beyond, bringing together comprehensive market access, advanced proprietary platforms, and professional tools.

The company’s long track record, global regulatory compliance, and extensive market reach make it a serious contender for experienced traders and investors seeking a comprehensive platform with depth in trading and investment products.

Key Features

Below are the key features that the IG platform offers:

- An intuitive web platform, powerful desktop interface, and mobile apps for trading on the go.

- Advanced charting and analysis tools, technical indicators, drawing tools, and custom layouts.

- For stocks and other assets, IG offers direct access to exchanges with transparent pricing.

- Built-in stop-loss, guaranteed stops, trailing stops, and real-time risk analytics.

- Competitive spreads and transparent commission structures across markets.

- Market news, daily analysis, webinars, economic calendars, and educational content.

- Practice trading risk-free with a fully interactive demo environment.

User Experience

From my experience using different online brokers for stock trading, IG delivers one of the most polished and professional trading environments.

The platform is robust, with a clean layout that balances powerful tools and usability.

Navigating between markets, charts, and open positions is smooth, and the execution quality is consistently fast and reliable across both desktop and mobile.

IG’s charting tools are highly responsive, with a wide selection of indicators and customisation options.

The built-in research, market commentary, and economic calendar are seamlessly integrated, allowing you to move from analysis to execution without switching platforms.

Risk management tools such as guaranteed stops are easy to apply and clearly explained, which adds confidence when placing trades.

Advantages

IG’s advantages make it a strong choice among online brokers for stock trading and broader investing.

- Trade thousands of global instruments, including stocks, indices, forex, commodities, ETFs, options, and cryptocurrencies.

- For stocks and other assets, IG offers direct access to exchanges with transparent pricing.

Limitations

IG’s drawbacks are important to consider if you’re new to trading or prioritise simplicity and low ongoing costs.

- The powerful tools and feature-rich platform can feel overwhelming for new investors who prefer simpler, more streamlined interfaces.

- While overall pricing is competitive, certain markets may carry spreads or fees that are higher than other brokers.

- Lack of direct advisory services.

Regulatory Compliance

The company’s UK entity, IG Markets Ltd, is authorised and regulated by the Financial Conduct Authority (FCA).

IG also holds licences from other major regulators including the Australian Securities and Investments Commission (ASIC), the Monetary Authority of Singapore (MAS), the Swiss Financial Market Supervisory Authority (FINMA), the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the United States, as well as various other regional authorities.

Being regulated by multiple top-tier financial authorities around the world underpins IG’s credibility as one of the most trusted online brokers for stock trading.

Furthermore, UK clients benefit from participation in the Financial Services Compensation Scheme (FSCS), providing protection up to £120,000 if the broker is unable to meet its financial obligations.

Security Features

The platform uses advanced SSL encryption to protect information transmitted between users and its systems, and supports two-factor authentication (2FA) as an additional layer of login security to reduce the risk of unauthorised access.

Customer Service

IG provides customer support using different channels, such as phone support, live chat, and email, with availability tailored to key regional markets.

The broker maintains dedicated telephone numbers for major regions such as the UK, Europe, Australia, and Asia, and support is typically available during local trading hours, often extending to accommodate active market sessions.

I really like the fact that I could pick up the phone and speak directly with a representative if I needed help with verification, funding questions, or trade discrepancies.

6. Plus500

Best For CFD Trading Across Global Markets

Compay Overview

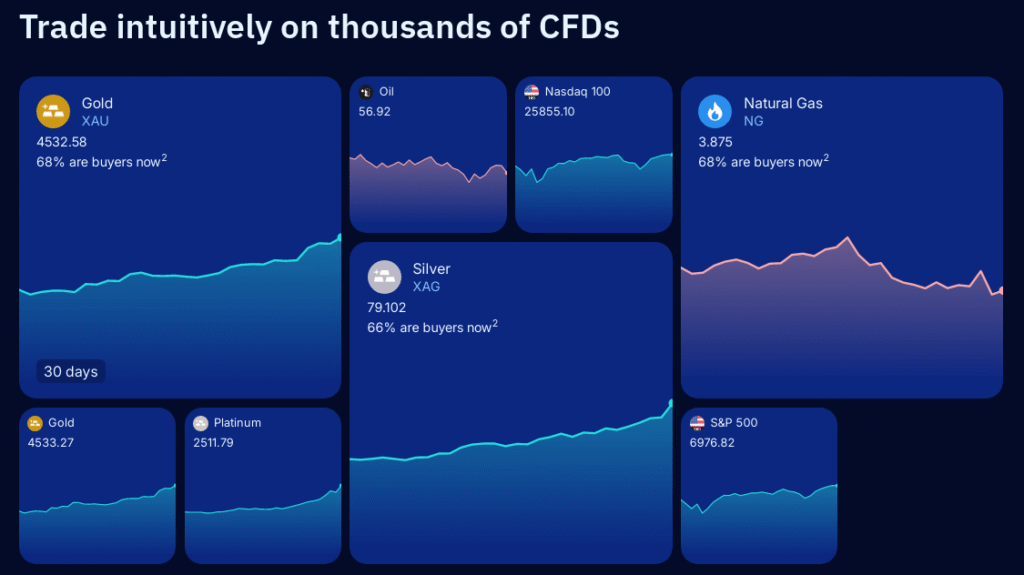

Plus500 is one of the most recognised online brokers for stock trading derivatives via Contracts for Difference (CFDs).

Launched in 2008 by six Technion graduates, Plus500 has become a major provider of CFDs and multi-asset trading services across 65 countries.

Its platform allows retail customers to trade CFDs on equities, indices, commodities, forex, ETFs, options and cryptocurrencies, all accessible through proprietary web, desktop and mobile apps.

The company has built a substantial global presence, with over 24 million registered users and a reputation for a streamlined, mobile-friendly experience that appeals to both new and experienced traders looking to speculate on price movements rather than hold underlying assets.

Plus500’s focus on CFD trading and derivatives provides access to a broad set of markets and instruments, but prospective users should be aware that CFDs involve leverage and carry significant risk.

Key Features

Plus500 is great for traders focused on CFD strategies and leveraged market exposure, with tools designed to support market insight and risk control.

- Proprietary web and mobile apps provide real-time price quotes, customizable charts, and fast trading without complex installation.

- Stay informed by setting price alerts and getting push notifications for key market moves.

- A unique sentiment tool that shows trends such as most-bought and most-sold instruments to support your decision-making.

- Stop-loss, take-profit, trailing stop, and guaranteed stop orders help you manage risk on leveraged positions.

- Built-in calendar highlights major economic events and scheduled announcements that may impact markets.

- Trade seamlessly across web, desktop, iOS, and Android apps with synced settings and alerts.

User Experience

As someone who has tested several online brokers for stock trading, Plus500 immediately impressed me with its intuitive interface and how easy it was to get started.

The platform is streamlined and uncluttered, with all essential tools like charts, open positions, account metrics and risk controls clearly laid out and accessible with a few clicks.

During use, execution was fast and responsive, with smooth trades placing across both desktop and mobile without noticeable lag.

Features like built-in stop-loss and take-profit controls are integrated directly into the order screen, making risk management natural.

The demo account mirrors the live platform closely, which helps you build practice strategies with confidence before committing real funds.

Price alerts and notifications were reliable and timely, so I could stay on top of market movements without constantly monitoring the platform.

Advantages

Plus500 offers several advantages when compared to other online brokers for stock trading.

- Trade thousands of CFD instruments including forex, indices, commodities, shares, ETFs, and options from a single platform.

- Unlimited demo account with virtual funds lets you practice and refine strategies before trading live.

- Transparent pricing

Limitations

It’s important to weigh Plus500’s limitation if your goals include long-term asset ownership or access to advanced research and education.

- Primarily offers CFDs and leveraged products, meaning you do not actually own underlying assets like stocks or ETFs, which may not suit buy-and-hold investors.

- The platform’s research and analytical tools are less advanced compared with brokers that provide in-depth market data and third-party research.

Regulatory Compliance

In the UK, Plus500UK Ltd, is authorised and regulated by the Financial Conduct Authority (FCA).

The broker also holds licences from the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), the Monetary Authority of Singapore (MAS), and other regional regulators including those in South Africa, New Zealand, and the Seychelles.

This multi-jurisdictional regulatory framework requires Plus500 to comply with strict financial rules typical of credible online brokers for stock trading and CFD providers.

In addition, UK clients may be eligible for compensation under the Financial Services Compensation Scheme (FSCS) up to £120,000 if the broker were to become insolvent.

Security Features

The platform uses 256-bit SSL encryption for all communications, helping safeguard sensitive information such as personal and financial data from interception.

Users can enable two-factor authentication (2FA) to add an extra layer of login security, ensuring that account access requires both a password and a second verification step.

Customer Service

Plus500 provides 24/7 customer support through several digital channels, primarily live chat, WhatsApp, and email, and also offers a comprehensive help centre and FAQ section to address common questions.

For me live chat is the fastest way to get help, the responses are prompt and the knowledgeable support agents can resolve routine issues quickly.

Email support is available for more detailed queries and typically receives replies within a few hours to a day, which is broadly in line with industry averages.

The availability of support in multiple languages matches the broker’s global user base.

7. Degiro

Best For European Retail Investors

Compay Overview

Degiro is a retail brokerage platform that has turned into one of the most recognised online brokers for stock trading and investing in Europe by offering low-cost access to a wide range of global markets and investment products.

Originally founded in 2008 by former BinckBank employees as an institutional broker, Degiro launched its services to retail investors in the Netherlands in 2013 and quickly expanded to markets such as Germany, France, Spain, Italy and the UK.

Degiro has won over 100 international awards recognising its low costs, platform quality, and mobile experience, and it continues to innovate with features such as real-time financial data, interactive charts, ESG ratings and analyst insights.

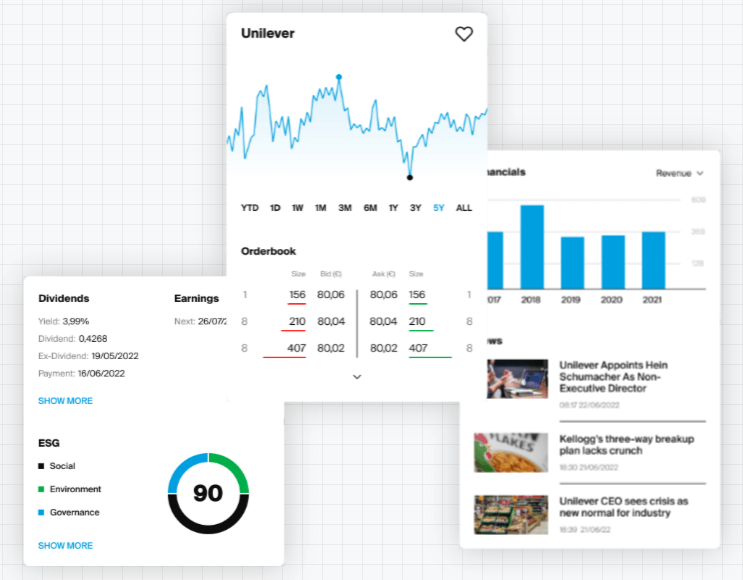

Key Features

Degiro’s features make it an appealing choice for investors focused on keeping costs low while accessing a broad range of global markets.

- Competitive pricing on stocks, ETFs, bonds, options, and futures, often significantly lower than traditional online brokers for stock trading.

- Trade on over 50 exchanges in more than 30 countries, including the US, UK, Europe, and Asia.

- Intuitive interfaces with essential order types, watchlists, and portfolio overviews.

- Degiro offers “Bundled Orders” for cost-efficient execution of small orders on certain markets.

- Optional real-time quotes and basic charts directly in the platform.

- Regular automated investing in select ETFs at low cost (availability varies by region).

- Clear trade confirmations, activity statements, tax reporting, and performance summaries.

User Experience

When I started using DEGIRO it stood out for its simplicity, speed, and cost transparency, compared with more traditional brokerages.

From the moment I opened an account, the platform’s streamlined design made navigating markets and placing trades straightforward and efficient.

The web and mobile interfaces are uncluttered, without sacrificing functionality, and essential tasks like searching for tickers, reviewing order books, and setting up watchlists are intuitive even if you’re new to investing.

Trade confirmations and portfolio updates appear after execution, with minimal delays and clear order breakdowns showing fee.

While the platform doesn’t overload you with advanced analytics, it could be a drawback for more seasoned traders and investors.

Advantages

Degiro’s advantages over other online brokers for stock trading, include:

- Straightforward, no-frills platform, focusing on execution efficiency, transparency, and ease of use rather than unnecessary complexity.

- Clear cost breakdowns and reporting, this helps investors understand exactly what they are paying on each trade.

Limitations

Here are some of the areas where Degiro falls short:

- Some features, such as savings plans for ETFs or fractional orders are only available in select countries, not uniformly across all markets.

- Degiro doesn’t offer dedicated cash-management services like debit accounts, high-yield savings, or linked banking features.

Regulatory Compliance

The broker is supervised by the Dutch Authority for the Financial Markets (AFM) and prudentially overseen by the Dutch Central Bank (DNB), which enforce strict standards under key EU directives like MiFID II covering investor protection, transparency, and conduct of business.

Degiro is also regulated by BaFin in Germany and registered with the Financial Conduct Authority (FCA) in the UK, so it must adhere to comprehensive rules on capital adequacy and operational governance applicable to online brokers for stock trading and investment services.

Security Features

Degiro supports two-factor authentication (2FA), which adds a second verification step at login to reduce the risk of unauthorized access.

All data transmissions are secured with encryption (SSL/TLS), protecting personal and financial information from interception.

Customer assets are legally segregated into separate entities, meaning shares and securities are held apart from Degiro’s operational balance sheet.

In addition, Derigo participates in the German Deposit Guarantee Scheme, which protects uninvested cash balances up to €100,000 per person.

Customer Service

Derigo customer support is primarily through email and an online contact form, operating during standard business hours in major European time zones.

The broker also provides a Help Centre with FAQs, platform guides, and instructional content useful for answering common questions.

Lack of live chat or dedicated phone support can be a drawback and because customer support is email-based, handling more complex account questions may take longer and require multiple email exchanges.

8. SpeedTrader

Best For Active Day Traders

Compay Overview

SpeedTrader is a U.S.-based broker focused on serving active and professional traders.

While not as widely known as some larger online brokers for stock trading the company has built a niche reputation for direct market access, execution speed, and trading flexibility within the U.S. markets.

Set up in 1999 and headquartered in New York, SpeedTrader provides tools and infrastructure designed to facilitate fast order routing and execution on major U.S. stock exchanges.

Key Features

These features make SpeedTrader especially well-suited for day traders, scalpers, and high-frequency traders.

- Per-share commission rates and flat-fee options for stocks and ETFs, geared toward high-volume traders.

- Advanced desktop, web, and mobile applications with Level-2 quotes, real-time market data.

- High-speed order execution.

- Customisable keyboard shortcuts, allowing faster trade entry and management.

- Advanced charting.

- Real-time data feeds.

- Multi-asset support.

- Fully functional mobile app with trading, monitoring, and alerts on the go.

User Experience

While I was testing online brokers for stock trading, SpeedTrader highlighted its strengths as a fast, execution-focused platform.

The setup felt geared toward serious execution, the login and data feeds were consistently stable, and real-time quotes updated without lag.

Desktop platform is a highly customizable workspace.

I could arrange multiple Level-2 windows, charts, and order entry panels exactly how I wanted, which helped me during fast-moving sessions.

The mobile app also offers alerts and fast response times that make it practical for monitoring positions on the move.

Advantages

SpeedTrader’s advantages revolve around speed, efficiency, and direct control over trade routing.

- Direct routing of orders to major U.S. exchanges (NYSE, NASDAQ, ARCA) for rapid execution.

- Customizable trading environment.

Limitations

Limitations to consider when comparing SpeedTrader to other online brokers for stock trading:

- Platform’s advanced tools and execution-focused layout can feel intimidating for new or casual traders.

- The suite of customisation options, hot keys, and advanced settings require time to master.

<strong>Regulatory Compliance

SpeedTrader operates as a fully regulated stock broker in the United States.

The firm is registered with the Securities and Exchange Commission (SEC) and is also a member of the Financial Industry Regulatory Authority (FINRA).

As a FINRA member, SpeedTrader is also part of the Municipal Securities Rulemaking Board (MSRB) framework for applicable products.

Security Features

The platform utilises SSL/TLS encryption for all data transmissions between clients and its servers.

Optional 2FA adds an extra layer of protection at login.

SpeedTrader is a member of the Securities Investor Protection Corporation (SIPC), therefore securities and cash held in customer accounts are protected up to $500,000 per customer in the unlikely event the broker fails financially.

Customer Service

SpeedTrader provides customer support through phone support, email, and live chat, available during U.S. market hours.

Since the platform caters largely to active and professional traders, I noted that the emphasis is on responsive, knowledgeable support rather than general consumer-oriented service.

9. Vantage

Best For Forex Trading

Compay Overview

Vantage is a global multi-asset brokerage and trading platform, often featured among the best online brokers for stock trading and diversified asset access.

Founded in 2009, originally as Vantage FX (forex), the company serves over 5 million registered users worldwide.

It also provides access to more than 1,000 CFD products including forex, indices, commodities, shares, ETFs, bonds, and cryptocurrencies.

Headquartered in Australia, Vantage offers a suite of trading platforms including MetaTrader 4, MetaTrader 5, WebTrader, TradingView integration, and ProTrader.

There is also a proprietary mobile app to suit both beginners and experienced traders worldwide.

Key Features

The Vantage platform offer plethora of tools to traders and investors.

- Trade CFDs on stocks, indices, forex, commodities, ETFs, bonds, and cryptocurrencies from one account.

- Fast execution.

- Advanced charting, tools, and custom timeframes to support analysis.

- Risk management tools.

- Built-in copy trading functionality.

- Market analysis, webinars, tutorials, and trading guides designed to support skill development.

- Customisable price alerts and notifications.

User Experience

After trying multiple online brokers for stock trading, Vantage delivered policed and adaptable performance.

The interface was responsive and well-structured, with clear navigation that made switching between MetaTrader 4, MetaTrader 5, and the proprietary web app effortless.

Execution speeds were consistently strong, and order confirmations appeared quickly, which helped maintains confidence when trading forex during more volatile market periods.

Advantages

Vantage stands out for combining professional-grade trading tools with accessible pricing.

- Access to multiple trading platforms.

- Tight spreads and competitive pricing.

Limitations

Here are some drawbacks to take into account if you’re planning to use the Vantage platform:

- Users don’t own the underlying assets, which may not suit traditional, long-term investors.

- Certain products like mutual funds or bonds are limited compared with full-service online brokers for stock trading.

Regulatory Compliance

Vantage Global Prime LLP is authorised and regulated by the UK Financial Conduct Authority (FCA).

UK clients benefit from coverage under the Financial Services Compensation Scheme (FSCS) up to £120,000, plus additional compensation arrangements such as excess insurance up to £1 million in some cases.

Moreover, Vantage holds licences from Australian Securities and Investments Commission (ASIC), Financial Sector Conduct Authority (FSCA) in South Africa, Cayman Islands Monetary Authority (CIMA), and Vanuatu Financial Services Commission (VFSC).

Security Features

Accounts and transactions are protected with SSL encryption to secure data transmissions against interception, and two-factor authentication (2FA) is supported to add an extra layer of login protection.

Customer Service

Vantage’s customer service is generally reliable and trader-friendly, offering multiple contact options such as live chat, email and phone support (selected regions), and helpful staff.

It may not be as extensive as brokers with dedicated global customer service teams, but for most platform and account needs, the quality and responsiveness are solid.

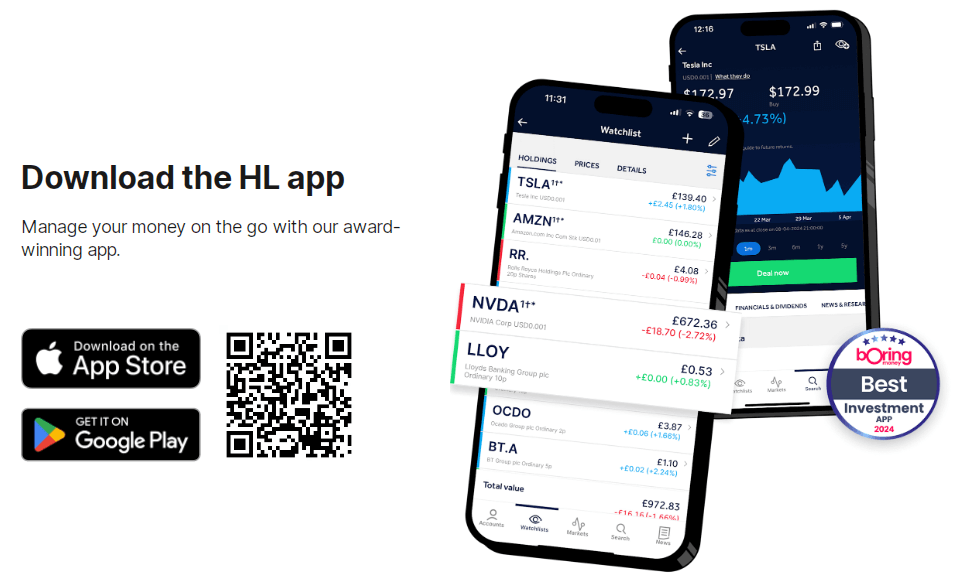

10. Hargreaves Lansdown

Best For Long-Tem UK Investors

Compay Overview

Hargreaves Lansdown is one of the UK’s leading online brokers for stock trading and long-term investing.

Launched in 1981 by Peter Hargreaves and Stephen Lansdown, the company has become Britain’s largest retail investment platform, headquartered in Bristol, England.

The company supports diversified investing across thousands of UK and international stocks, funds, ETFs and other assets, with tax-efficient wrappers that help investors build portfolios over time.

In 2025, it was acquired by a consortium including CVC Capital Partners, Nordic Capital and the Abu Dhabi Investment Authority, reflecting its scale and market position.

Hargreaves Lansdown’s features make it a strong choice for investors focused on long-term growth, tax-efficient savings, and portfolio management.

- Supports Stocks & Shares ISAs, and Self-Invested Personal Pensions (SIPPs) to help investors build tax-advantaged long-term portfolios.

- Managed portfolio options.

- Comprehensive market research, expert fund analysis and stock insights.

- Intuitive web and mobile platforms.

- Regular savings plans.

- Access to in-depth educational resources.

- Dividend management.

- Retirement planning calculators, risk profiling, and performance forecasting to support long-term financial goals.

User Experience

Using online brokers for stock trading like Hargreaves Lansdown is great option if you’re focused on building and managing a diversified portfolio.

The platform is intuitive and purpose-built for long-term investors.

The desktop and mobile app present portfolios, performance charts, and upcoming actions (like dividends) clearly, making it easy to track progress toward my goals.

I like the ability to set up monthly savings plans and automate contributions, which reinforce disciplined investing without constant manual input.

Advantages

Hargreaves Lansdown is suitable for investors focused on long-term wealth building, diversified portfolios, and tax-efficient investing.

- Tax-efficient accounts.

- Managed portfolio options.

- Automated regular investing into funds and shares.

Limitations

Some of Hargreaves Lansdown’s limitations to keep in mind include:

- Not designed for active trading.

- HL doesn’t offer a commission-free tier for stocks and ETFs, which may deter cost-sensitive investors.

Regulatory Compliance

As a UK company, Hargreaves Lansdown is authorised and regulated by the Financial Conduct Authority (FCA).

This regulatory oversight is designed to protect investors and ensure transparent, compliant operations by financial firms and online brokers for stock trading and investing.

As an FCA-regulated firm, eligible clients are covered by the UK Financial Services Compensation Scheme up to £120,000 per person if HL were unable to meet its financial obligations.

Security Features

Hargreaves Lansdown supports 2FA at login.

The platform uses SSL/TLS encryption to secure data transmissions.

They also includes tools for monitoring account activity and sending alerts for sign-ins or changes, helping users quickly identify potential security concerns.

Customer Service

Hargreaves Lansdown provides support through telephone, email, live chat, and online messaging.

Customer service is offered during UK business hours, and dedicated lines are available for general enquiries, ISA/SIPP queries, trading support, and technical assistance.

The platform also includes an extensive Help Centre with FAQs, guides, and investment-related articles that I found useful for self-service.

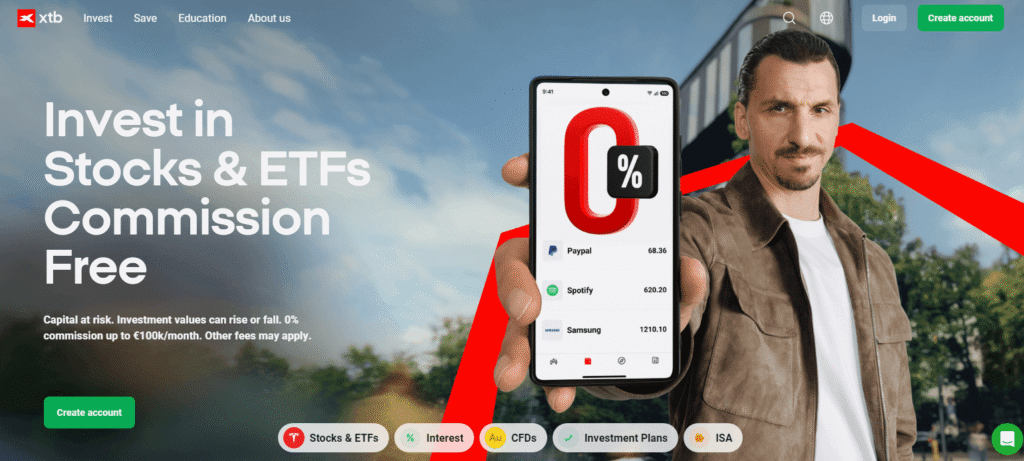

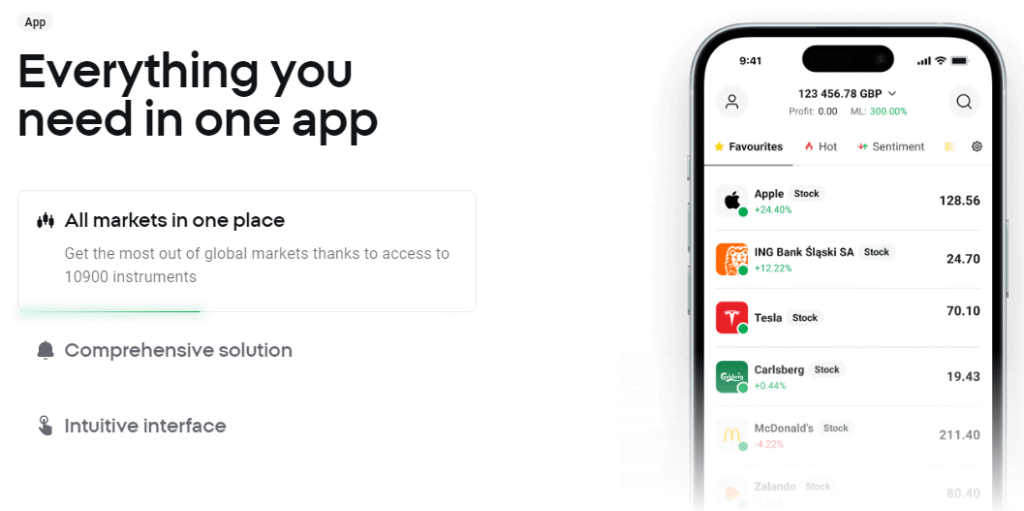

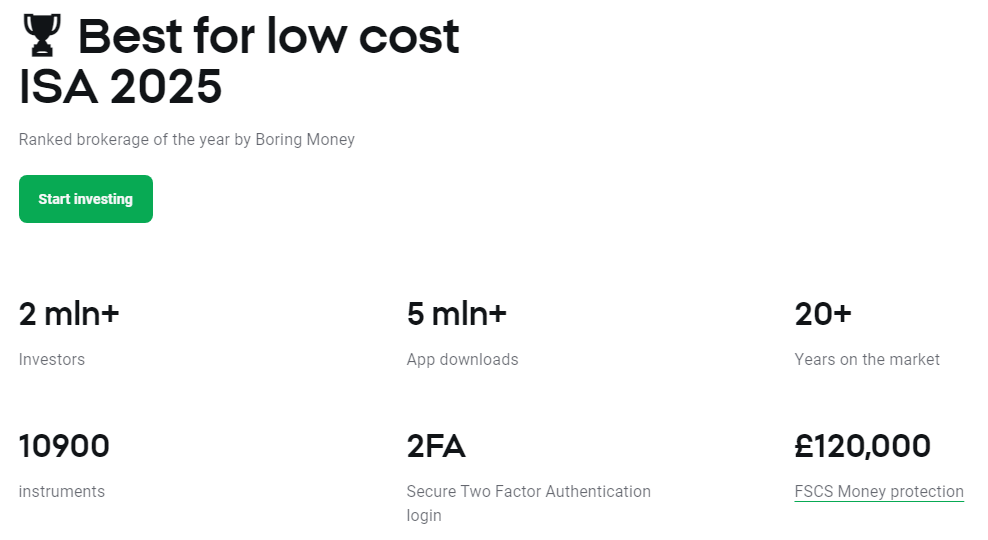

11. XTB

Best For Investing & Saving Using A Single App

Compay Overview

XTB is a Warsaw-based global brokerage and investment platform that enables users to access broad range of financial instruments through a single app.

Founded in 2004 as X-Trade Brokers and later rebranded to XTB, the company expanded internationally and is now one of the largest online brokers for stock trading.

The platform is currently serving 2+ million users worldwide.

XTB offers a unified solution for investors to build and diversify long-term portfolios.

It gives access to savings plans, earn interest on uninvested cash, and benefit from fractional shares, making it suitable for both trading and passive saving strategies.

Key Features

XTB is a flexible, all-in-one platform suited for both active traders and investors focused on saving and long-term growth.

- Multi-asset access.

- CFD trading on leveraged products and commission-free stock/ETF investing (within applicable volume limits and regions).

- Fractional shares.

- Transparent fee structures for stock investing and withdrawals.

- Real-time quotes and charts.

- Stop-loss, take-profit, and other order types to control risk exposure.

- Educational resources.

- Demo account with virtual funds.

User Experience

XTB is among the most versatile online brokers for stock trading.

It’s thoughtfully built for users who want a single place to manage investing, saving, and market participation with confidence.

The xStation app is modern, and easy to navigate, making it simple to move between long-term investments, savings features, and active positions from a central dashboard.

Portfolio performance, available cash, and open trades are clearly displayed, so nothing feels overly technical.

In addition, savings tools and idle cash features are integrated naturally into the platform, encouraging a more balanced approach to investing rather than constant trading.

Advantages

The main advantages that XTB offers are:

- One app for trading, investing, monitoring positions, and managing cash.

- Integrated savings and portfolio building tools.

Limitations

Limitations are important to consider if your priority is straightforward long-term investing without volume and region-specific restrictions.

- Compare to online brokers for stock trading, XTB’s commission-free stock/ETF investing is subject to volume limits and regions.

- Certain features like asset types, savings plans, or tax-efficient wrappers aren’t available in all jurisdictions.

Regulatory Compliance

Its UK entity, XTB Ltd, is authorised and regulated by the Financial Conduct Authority.

The company also holds licences from the Cyprus Securities and Exchange Commission (CySEC) and is overseen by the Polish Financial Supervision Authority (KNF) in its home market.

Additional oversight comes from authorities like the Comisión Nacional del Mercadode Valores (CNMV) in Spain and the International Financial Services Commission (IFSC) in Belize.

Security Features

The platform offers two-factor authentication (2FA).

The platform also allows authentication via password, fingerprint, or device codes, and uses multi-factor confirmation for key account changes to enhance overall security.

Customer Service

XTB customer support comes in the form of live chat, email, and phone, with availability generally aligned to market hours across key regions.

Like many online brokers for stock trading, I found the XTB live chat support to be quick to connect and capable of resolving routine questions efficiently.

There is also a Help Centre and educational content, covering a wide range of topics, but you may prefer direct responses for complex matters.

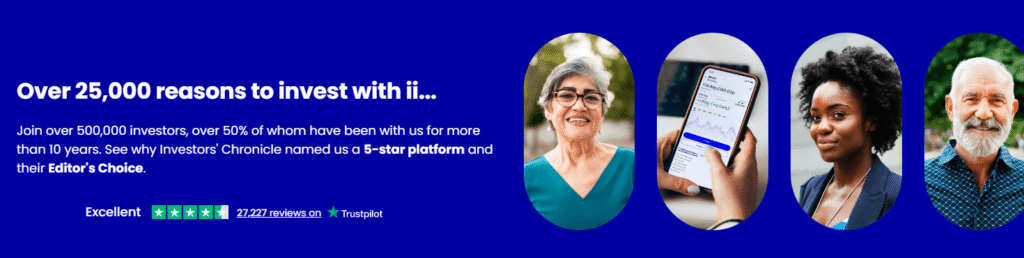

12. Interactive Investor

Best For Flat-Fee Investing

Compay Overview

Interactive Investor (ii) was created to serve the growing community of self-directed investors seeking cost-effective and comprehensive investment solutions.

Incorporated in 1995 and headquartered in Manchester, it operates as a subsidiary of Aberdeen Asset Management (Abrdn plc), which acquired the business in 2022.

Interactive Investor differentiates itself in the UK market as the largest flat-fee investment platform, offering an alternative to percentage-based charging structures common for traditional online brokers for stock trading.

The clients pay a fixed monthly fee regardless of the value of their portfolio, which can be cost-efficient for investors with medium to large investment balances.

Key Features

Interactive Investor offers a robust set of tools and accounts tailored for long-term wealth builders.

- Diverse account types and tax wrappers.

- Global investment universe with access to a massive range of assets across 17 global exchanges.

- Simplified three-tier, flat-free pricing structure: Core, Plus, and Premium.

- Auto dividend reinvestment function.

- ii360 Platform, offering advanced trading interface.

- Ready-made portfolios based on different risk appetites e.g., active income or low-cost growth.

- 40,000+ UK & international shares, Funds, ETFs, investment trusts, bonds and gilts.

User Experience

Having tested the platform, I can say that Interactive Investor doesn’t just provide a place to trade; it provides a place to own your investments.

While many online brokers for stock trading focus on the speed of the transaction, ii focuses on the experience of the shareholder.

Their app has clean, data-rich interface.

The dashboard offers a high-level, single-screen overview of your entire financial life.

It’s particularly satisfying for those who want to see the big picture of their net worth without digging through menus.

Multi-currency wallet feels like a premium feature that many other platforms overlook.

Advantages

Interactive Investor is unique because its flat-fee model often bundles multiple accounts into one monthly price.

- The flat-fee gives you psychological peace that your costs don’t grow just because your wealth does.

- Multi-currency wallet, holding up to 9 different currencies.

Limitations

Here are the primary limitations to keep in mind when comparing Interactive Investor to other online brokers for stock trading.

- The flat-fee model is ii’s greatest strength, but it is also its biggest barrier for beginners.

- No fraction shares.

Regulatory Compliance

Interactive Investor Services Limited is fully authorized and regulated by the Financial Conduct Authority (FCA) in the UK.

If the broker fails and there is a shortfall in your segregated assets, you’re protected up to £120,000 per person.

The company isn’t regulated in the U.S., though it provides access to US markets.

Security Features

Interactive Investor uses two-factor authentication (2FA).

The mobile app supports Face ID and Fingerprint recognition.

And all data in transit and at rest is protected using 256-bit SSL encryption, the industry standard for financial institutions.

Customer Service

While many brokers have moved toward chat-only models, ii continues to prioritize direct communication through telephone and secure messaging.

Their primary contact centre is based in the UK, with staff available Monday to Friday with extended hours for international queries.

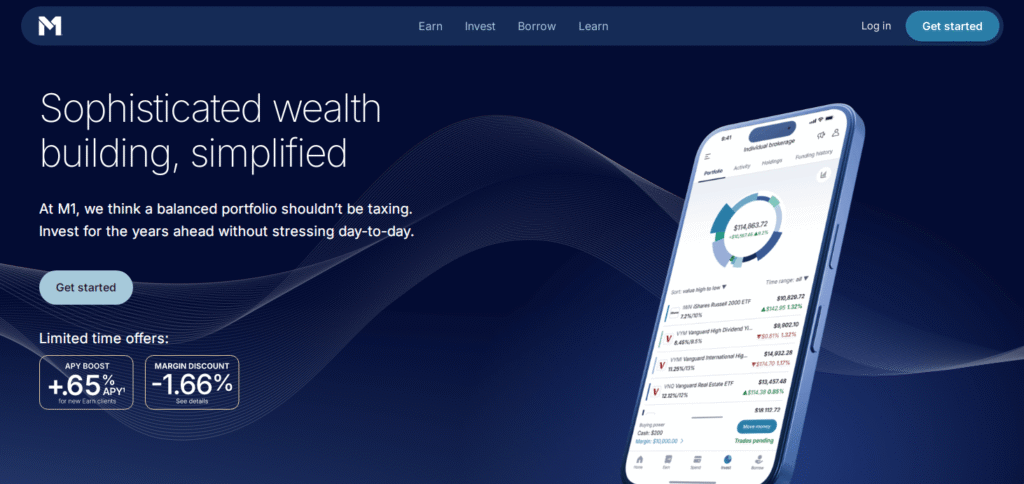

13. M1 Finance

Best For Automated Stock Portfolio Management

Compay Overview

M1 Finance is a Chicago-based fintech firm that has redefined the landscape for online brokers for stock trading by pioneering a pie-based approach to automated investing.

Founded in 2015 by CEO Brian Barnes, it’s a finance super app that blends the customization of a traditional brokerage with automation of a robo-advisor.

M1 is best for long-term, set-and-forget investors who want to build a diversified portfolio without manually calculating trade sizes or rebalancing.

Its core philosophy revolves around Pies, where users assign percentage weights to different slices (assets).

Whenever you deposit cash, the platform’s Dynamic Rebalancing algorithm automatically buys the most underweight slices to keep your portfolio on track.

Key Features

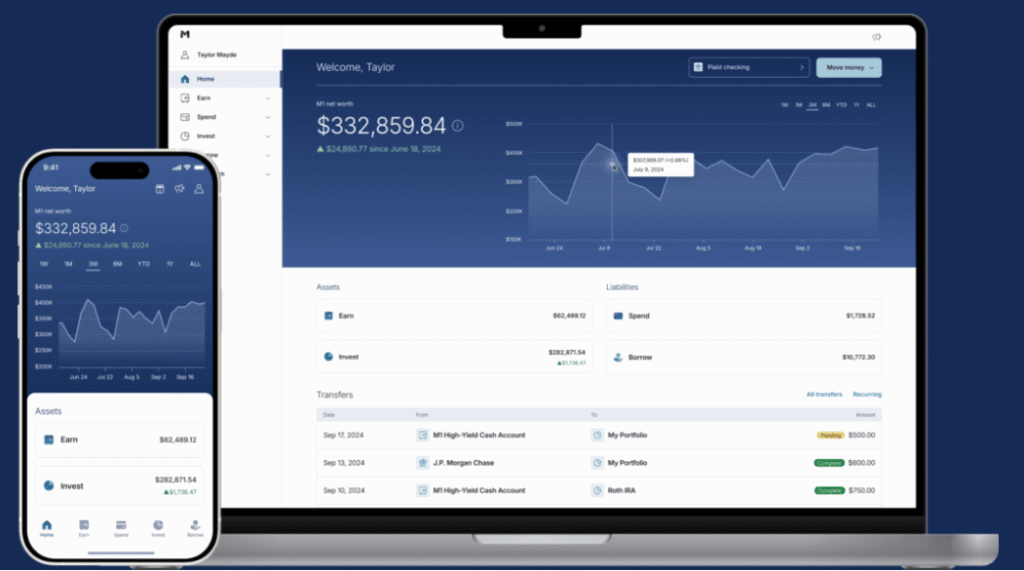

M1’s ecosystem integrates investing, borrowing and high-yield cash management into a single, automated workflow.

- Visual portfolio management system though custom pies.

- Custom pies.

- Over 60 Expert Pies modelled after famous investors, or specific industries.

- Automated robo-advisor.

- Fractional shares.

- Integrated banking and credit directly into your investment account.

- High-yield on univested cash.

User Experience

While most online brokers for stock trading focus on the Buy and Sell buttons, M1 is centred entirely on the Pie interface, a visual and intuitive way to see your wealth.

When you log in, you aren’t greeted by a chaotic ticker symbols, instead, you see your custom-designed slices of the market, perfectly organized and aligned with your goals.

I had my “aha” moment after I made my first deposit.

Thanks to the Dynamic Rebalancing, I didn’t have to worry about overvalued stocks or lagging ETFs.

I simply transferred my funds, and M1’s robot went to work, automatically allocating the cash into the underweight slices.

Advantages

M1’s advantages are cantered around extreme automation and a super-app ecosystem most traditional broker can’t match.

- Ultimate portfolio automation, including Dynamic Rebalancing feature.

- Smart transfers allow you to automate your entire financial life through threshold-based rules.

Limitations

M1 isn’t a one-size-fits-all solution for those who prioritize control or have smaller balances.

- Monthly platform fee depending on your balance.

- Restricted trading windows, instead of instant trading.

- Account closing fee.

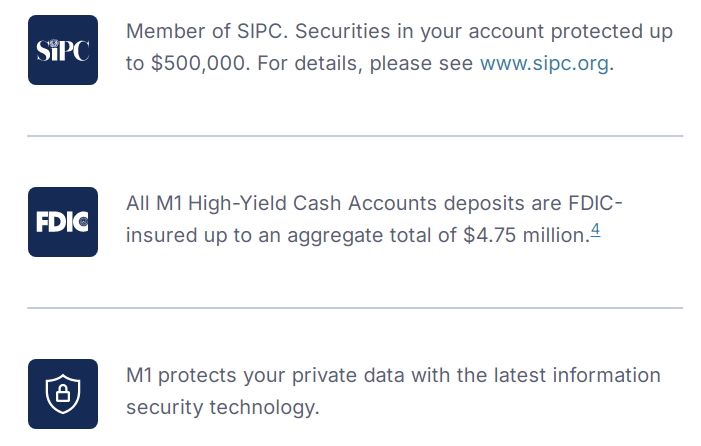

Regulatory Compliance

Like most online brokers for stock trading, M1 Finance LLC is a registered broker-dealer with the Securities and Exchange Commission (SEC) in the U.S.

They’re an active member of the Financial Industry Regulatory Authority (FINRA).

Through its acquisition of B2 Bank NA, M1 also operates within the federal banking regulatory framework.

Your brokerage account is also protected by the Securities Investor Protection Corporation (SIPC) up to $500,000 (including up to $250,000 for cash claims) if M1 Finance were to fail.

Security Features

M1 utilizes mandatory 2FA and military-grade data encryption.

Their mobile app supports FaceID and Fingerprint Recognition and they also use AI-driven fraud detection that monitors for suspicious activity.

Customer Service

M1’s support channels include chat, messenger, email and telephone.

In my experience, the email response times generally ranged from 24 to 48 hours, though I was advised that users on the “Plus” tier are prioritized.

Although there is phone support, it’s intended for urgent issues like account security or wire transfers.

Best Online Brokers For Stock Trading: Conclusion

In conclusion, selecting the right platform can make all the difference in your trading or investing journey.

The best online brokers for stock trading offer more than just low fees, they combine intuitive interfaces, powerful tools, solid security, regulatory protection, and reliable customer support.

By considering each broker’s features, advantages, and limitations, you can choose a platform that fits your trading style and goals or help you invest smarter and manage your portfolio with confidence.

Disclaimer: This article contains affiliate links. If you sign up for a stock trading platform through my links, I may receive small affiliate compensation at no cost to you. You can read my affiliate disclosure by going to my privacy policy. The article is for informational and educational purposes only and does not constitute financial, investment, or legal advice.

Best Online Brokers For Stock Trading: FAQs

Next, we’ve compiled a list of frequently asked questions to help answer common queries and provide additional clarity on choosing and using the best apps for stock trading.

Q: Which broker is the best for trading for beginners?

A: Webull is one of the best online brokers for stock trading and investing for beginners because it blends a user-friendly interface with powerful tools that newcomers can grow into.

Unlike ultra-basic platforms that limit functionality, Webull offers intuitive trade execution, zero-commission trading, extended hours access, and research tools that help first-time investors learn while they invest.

Its mobile and desktop apps are clean and responsive, making everyday tasks like placing a trade, tracking a watchlist, or reviewing account performance straightforward.

At the same time, features like paper trading allow beginners to practice strategies with virtual funds before committing real capital.

These qualities make Webull suitable for new investors who want a platform that’s easy to start with but still robust enough to support learning and growth as their experience increases.

–

Q: How to choose the best stock broker?

A: Choosing from the best online brokers for stock trading and investing comes down to matching the platform’s strengths with your goals, experience level, and trading style.

The most important factors to evaluate include:

1. Costs and fees

Review trading commissions, spreads, account fees, and any inactivity or withdrawal charges.

Even small fees can add up over time, especially for active traders or long-term investors.

2. Ease of use and platform quality

A well-designed trading platform should be intuitive, stable, and fast.

Look for clean navigation, reliable order execution, and mobile apps that mirror desktop functionality if you plan to trade on the go.

3. Available markets and assets

The best brokers provide access to a wide range of instruments, including stocks, ETFs, options, and sometimes international markets.

Make sure the broker supports the assets you plan to invest in.

4. Research, tools, and education

Quality charting tools, market data, analyst reports, and educational content can significantly improve decision-making.

This is especially important for beginners and self-directed investors.

5. Regulation and security

Always choose online brokers for stock trading and investing regulated by reputable authorities such as the SEC, FCA, or FINRA.

Strong security features like two-factor authentication, encryption, and investor protection schemes that safeguard your capital are non-negotiable.

6. Customer support

Responsive and knowledgeable customer service matters, particularly when dealing with account issues, funding, or technical problems.

Check availability, contact methods, and user feedback.

7. Suitability for your experience level

Some brokers are built for beginners with simple interfaces and guided tools, while others cater to advanced traders with complex analytics and customization.

Choose one that fits how you invest today, while still supporting your growth over time.

By carefully weighing these factors, you can narrow down the best brokers for stock trading and select a platform that supports your strategy, protects your capital, and delivers a reliable overall experience.

–

Q: Is online stock trading actually free?

A: While many brokers like Webull offer $0 commission trading, they monetize your activity in ways that aren’t always obvious.

Payment for Order Flow (PFOF)

A lot of brokers sell your trades to market makers who pay the broker a small fee.

In exchange, you might receive a slightly worse price on your stock, a few cents difference that adds up over time.

FX Markups

If you are a UK investor buying U.S. stocks, brokers often charge a conversion fee, ranging from 0.15% to 1.5%.

On a £10,000 trade, a 1% markup is a hidden £100 cost, making the “free” trade more expensive than a flat-fee broker.

–

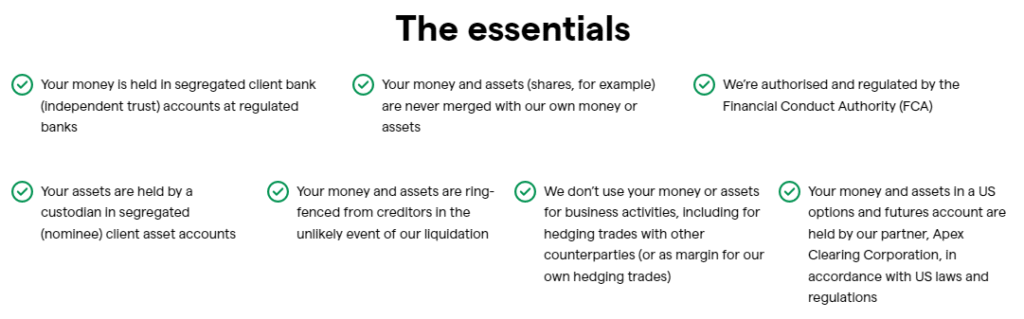

Q: How safe is my money if a broker goes out of business?

A: The protection that online brokers for stock trading and investing offer depends on your region and the type of asset held.

In the USA, Securities Investor Protection Corporation (SIPC) protects up to $500,000 per customer (including $250,000 for cash).

The UK Financial Services Compensation Scheme protects of up to £120,000 in the event of a firm failure.

Regulated stock brokers must keep client assets in a separate legal entity from their own funds.

This ensure that if the broker goes bankrupt, your shares remain yours.

–

Q: Can I trade fractional shares on all platforms?

A: Not all platforms offer fractions shares, though the feature is becoming more popular.

In the past, if a share of a company like Amazon cost thousands of dollars, you couldn’t buy it unless you had that enough cash.

Today, the best online brokers for stock trading use fractional shares to slice these expensive stocks into tiny pieces.

This way they allow you to invest based on dollar amounts rather than share counts.

Here is how fractional shares work:

When you buy a fractional share, you aren’t buying a part of a share on the open market because the stock exchange only deals in whole units.

Instead, your broker buys a whole share, keeps it in custody, and then divides the economic rights among multiple customers.

The math:

If a stock is trading at $1,000 and you invest $100, your broker will credit your account with 0.1 shares.

The profit:

If that stock price rises by 10%, your $100 investment grows to $110, exactly as if you owned a full share.

The benefits that you get include:

1. Precision dollar-cost averaging.

Instead of trying to time the market to afford a whole share, you can set an automated rule to invest, say, $50 every Friday.

Regardless of the share price, your money is always working.

2. Instant diversification.

With just $100, you can own a piece of 10 different “Magnificent Seven” tech giants.

Without fractional shares, that same $100 may not even buy a single share of one of them.

3. Dividend participation.

You still earn dividends!

If a company pays a $2.00 dividend per share and you own 0.5 shares, the broker will automatically deposit $1.00 into your account.

Things to be aware of:

While fractional shares are revolutionary, they come with specific limitations that vary across the different online brokers for stock trading:

No voting rights

- In most cases, because the broker technically holds the whole share in their name, you don’t get to vote in shareholder meetings.

Non-transferable

- You usually cannot transfer fractional shares to another broker. If you want to switch platforms, you typically have to sell the fractional portion and move the cash.

Order Execution

- Some brokers aggregate fractional orders and execute them in batches at specific times of the day, meaning you might not get the exact real-time price that a whole-share buyer gets.

Check your broker’s policy because some platforms like InteractiveBrokers allow real-time fractional trading, while others like M1 Finance only execute during specific trading windows.

Online Brokers For Stock Trading: Recommended Articles

Below you can find articles related to starting a blog, making money online and review of the software stack you need to take your idea online and make it a success: